Few institutions wield as much influence over the modern global economy as the United States Federal Reserve. Its decisions ripple across markets, shape national debt, determine borrowing costs, and affect everything from home loans to international trade. Yet, for most people, the Federal Reserve—commonly known simply as “the Fed”—remains an enigma. What exactly does it do? Who does it serve? And how does it wield such immense, often invisible power?

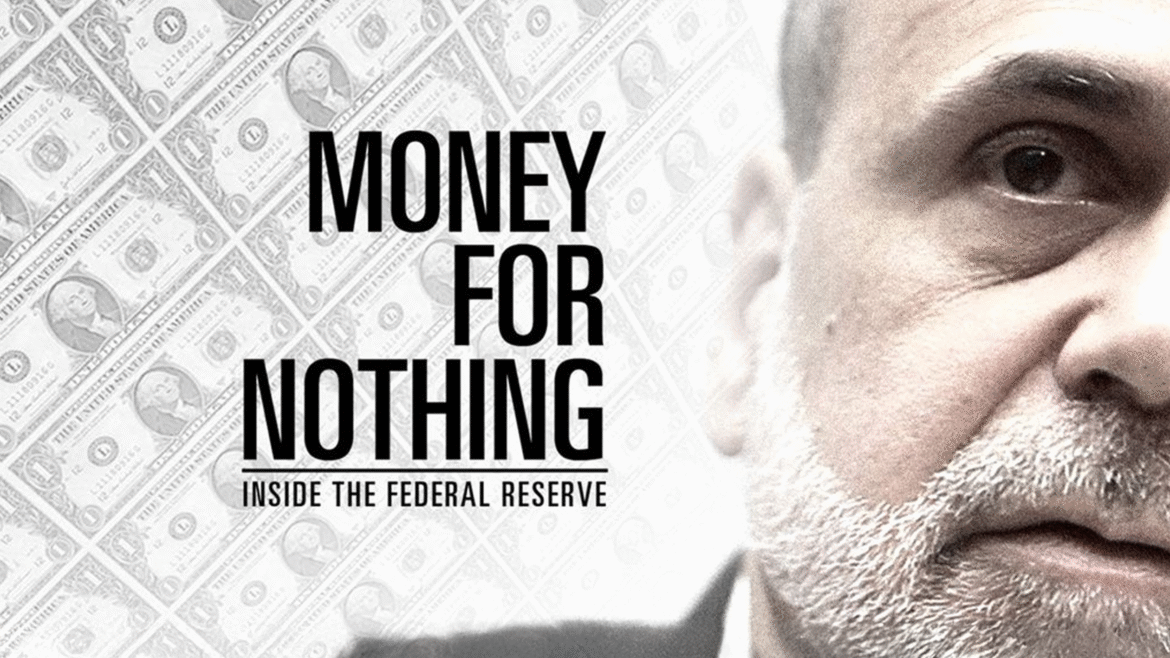

The 2013 documentary Money for Nothing: Inside the Federal Reserve, directed by Jim Bruce, seeks to answer these questions by lifting the veil on one of the most powerful—and misunderstood—institutions in the world. It’s an exploration not only of monetary policy and central banking, but also of human judgment, economic philosophy, and the delicate balance between stability and crisis.

Narrated by actor Liev Schreiber, the film features candid interviews with some of the most influential figures in modern finance, including former Fed chairmen Paul Volcker, Alan Greenspan, and Ben Bernanke, along with economists, investors, and policymakers. Together, they paint a vivid picture of how the Federal Reserve’s decisions have shaped the trajectory of the U.S. economy over the past century.

The Birth of the Federal Reserve: An Institution Built on Crisis

To understand the film’s message, it’s helpful to recall how the Federal Reserve came into being. Established in 1913, the Fed was created in response to a series of devastating financial panics that exposed the fragility of America’s banking system. Prior to its creation, the economy was prone to violent booms and busts—bank runs, collapses in credit, and widespread unemployment were common features of early capitalism.

The Fed’s initial mission was relatively straightforward: to provide financial stability. It was meant to be a lender of last resort, capable of injecting liquidity into the system during times of crisis. But over the decades, its mandate evolved. The Fed became not just a stabilizer but a driver of economic growth, employment, and inflation control. By the time of the Second World War, it had become central to the functioning of the entire financial system.

Money for Nothing traces this evolution carefully, illustrating how a body designed to maintain stability gradually became the architect of economic destiny. This transformation—though necessary in some respects—also sowed the seeds of controversy. The film argues that with great power comes great risk, especially when that power is concentrated in the hands of unelected officials whose decisions can reshape entire economies.

The Power of Money Creation

One of the most fascinating insights from the film is its explanation of how the Fed effectively creates money. Contrary to popular belief, money in a modern economy is not simply printed by the government—it is created largely through lending. When the Federal Reserve buys government bonds or lowers interest rates, it increases the amount of money in circulation by encouraging banks to lend more freely. This process—known as monetary policy—is the primary tool by which the Fed stimulates or cools the economy.

But as the documentary reveals, this mechanism can be both a blessing and a curse. Easy money policies can fuel growth, investment, and job creation, but they can also inflate asset bubbles and encourage reckless borrowing. By manipulating interest rates and the supply of credit, the Fed plays a constant balancing act between growth and stability, inflation and deflation.

The film draws attention to the housing bubble of the 2000s, which ultimately led to the financial crisis of 2008. Many analysts, including some former Fed insiders, argue that the seeds of that crisis were sown during the tenure of Alan Greenspan, whose policy of maintaining low interest rates after the dot-com crash created an environment ripe for speculation. When the bubble burst, the entire global economy teetered on the brink of collapse.

The 2008 Financial Crisis: A Test of the Fed’s Role

Much of Money for Nothing centers on the events surrounding the 2008 financial crisis—a watershed moment that tested the limits of the Federal Reserve’s power and credibility. As the subprime mortgage market imploded and financial institutions began to fail, the Fed stepped in with unprecedented measures: slashing interest rates to near zero, bailing out major banks, and implementing massive programs of quantitative easing (QE)—essentially printing money to buy government securities and stabilize the economy.

Supporters of these actions, including then-Chairman Ben Bernanke, argue that they prevented a complete economic collapse. Bernanke, a scholar of the Great Depression, believed that inaction would have triggered a catastrophic chain reaction similar to the 1930s. By injecting liquidity and restoring confidence, the Fed kept credit markets functioning and helped lay the groundwork for recovery.

However, critics featured in the film raise important concerns. They argue that while the Fed’s interventions prevented immediate disaster, they also entrenched systemic risks, rewarded reckless behavior, and widened the gap between Wall Street and Main Street. By rescuing financial institutions deemed “too big to fail,” the Fed effectively encouraged future risk-taking—knowing that, in the end, the central bank would step in again.

Inflation, Inequality, and the Human Impact

Beyond the mechanics of monetary policy, Money for Nothing delves into the social consequences of the Fed’s decisions. Low interest rates and easy credit policies have profound effects on ordinary people—often in ways that aren’t immediately visible. When the Fed keeps rates artificially low, it can inflate the stock market and boost asset prices, benefiting the wealthy who own those assets. Meanwhile, savers and retirees—those relying on interest income—see their returns diminish. The result is a subtle but powerful redistribution of wealth from the cautious to the speculative.

This dynamic, the film suggests, has contributed to the growing inequality in America. By propping up markets through quantitative easing, the Fed inadvertently made the rich richer while doing little to help the broader economy. The stock market soared, but wages stagnated, and real economic mobility declined.

Money for Nothing doesn’t vilify the Fed outright, but it does invite viewers to consider the moral dimensions of monetary power. It asks whether an institution tasked with maintaining economic stability should also bear responsibility for the broader social effects of its policies. In this sense, the film becomes not just an economic documentary, but a philosophical reflection on fairness, accountability, and the human cost of financial engineering.

A Rare Look Inside the Fed

One of the film’s greatest achievements is its access. Interviews with former Federal Reserve chairmen—Volcker, Greenspan, and Bernanke—offer rare insight into the inner workings of an institution that usually operates behind closed doors.

Paul Volcker, who led the Fed through the inflation crisis of the late 1970s and early 1980s, speaks candidly about the painful decisions required to tame runaway inflation—decisions that sent interest rates soaring and plunged the U.S. into a recession, but ultimately restored long-term stability.

Alan Greenspan, who served from 1987 to 2006, offers his defense of a philosophy that favored market self-regulation—an ideology that, according to many critics, failed spectacularly in the face of the 2008 crisis.

And Ben Bernanke, the academic-turned-central banker, explains how the Fed’s emergency measures after 2008 were not simply acts of rescue but necessary steps to preserve confidence in the system itself.

Through these testimonies, Money for Nothing captures the complexity of the Federal Reserve’s role. The Fed is not a villainous cabal of elites pulling strings from the shadows; it’s a collection of economists and policymakers grappling with immense uncertainty, trying to steer the world’s largest economy through turbulence without a clear map.

Style, Tone, and Impact

Jim Bruce’s direction is measured and clear, balancing technical explanation with storytelling. The pacing is deliberate, allowing viewers to absorb intricate financial concepts without feeling overwhelmed. Charts, archival footage, and interviews blend seamlessly to create a narrative that is both educational and dramatic.

Liev Schreiber’s narration lends gravitas, guiding the audience through a century of economic history without losing focus. The film’s tone is not alarmist but cautionary—it doesn’t push conspiracy theories or ideological extremes. Instead, it encourages viewers to think critically about power, transparency, and the unintended consequences of policy.

By the end, Money for Nothing feels less like a documentary about banking and more like a meditation on trust—the invisible currency that sustains both the economy and society itself.

Conclusion: The Invisible Hand Behind the Curtain

Money for Nothing: Inside the Federal Reserve is a thoughtful, meticulously crafted exploration of an institution that quietly shapes the destiny of nations. It doesn’t vilify or glorify the Fed but humanizes it—revealing its strengths, flaws, and the daunting complexity of its mission.

The film leaves viewers with more questions than answers: Should unelected officials wield such immense power? Is perpetual economic growth sustainable? And can a system built on credit and confidence endure indefinitely without consequence?

In the end, Money for Nothing reminds us that the most powerful forces in the world are often the least visible. The Federal Reserve may not print headlines daily, but it prints the policies that shape our lives—determining the price of money, the rhythm of the economy, and the boundaries of financial stability.

It’s a film that invites reflection not just on the economy, but on the nature of control itself—who has it, how it’s used, and what happens when trust in the system begins to erode.